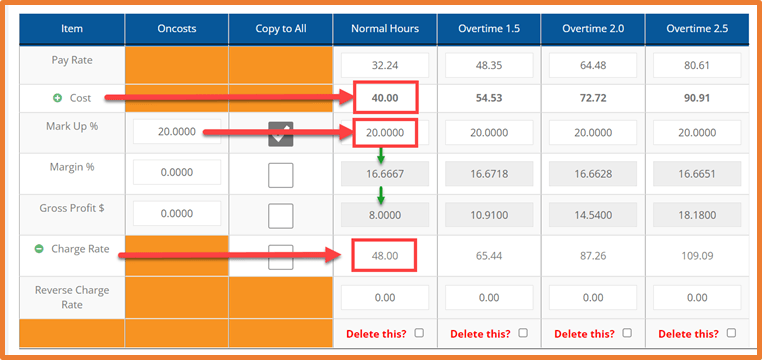

20% Mark-Up of our $40 cost rate = $48 charge rate ($8 profit)

As you can see, RatesCalc will also show you the equivalent calculations for margin and gross profit.

So, a 20% net mark-up is the equivalent of a 16.6667% gross margin.

As much as we love recruitment, we wouldn’t be here if our businesses didn’t earn a profit, right?

Calculating your revenue is key to a thriving recruitment business and the decisions we make when calculating our charge rates to clients is critical to our success.

How should you calculate your charge rates?

1. Work out what it costs you to put the person on the job.

Cost Rate = Pay Rate + Other Costs

(such as superannuation, payroll tax, workcoverFina, finance, admin fees and other oncosts)

2. Now let’s work out a charge rate that ensures a profit!

a) Dollar Margin

Simply, a dollar amount added on top of your cost rate!

Eg. We’ll add $8 onto every hour they work.

b) Mark-Up Percentage (gross margin)

Your profit is a percentage of your cost rate.

Eg. We want to mark-up our cost rate by 20%, so:

We need to multiply our cost rate by 1.2 (120%) to get the charge rate.

If our cost (what we pay the worker plus oncosts) is $40, a 20% mark-up (40 x 1.2) gives us a charge rate of $48.

c) Margin Percentage (net margin)

Your profit is a percentage of your charge rate.

Eg. If our charge rate is $48, and our cost is $40, what is our profit margin?

We need to subtract our cost rate from our charge rate (48 - 40 = 8), then divide that figure by the charge rate (8 / 48 = 0.1666) (16.66%)

If you want to apply a particular margin, eg. we want 20% of our charge rate to be profit: divide your cost rate by 0.8 (80%) to get your final charge rate (40 / 0.8 = 50) ($50)

Have a look at these examples in RatesCalc:

20% Mark-Up of our $40 cost rate = $48 charge rate ($8 profit)

As you can see, RatesCalc will also show you the equivalent calculations for margin and gross profit.

So, a 20% net mark-up is the equivalent of a 16.6667% gross margin.

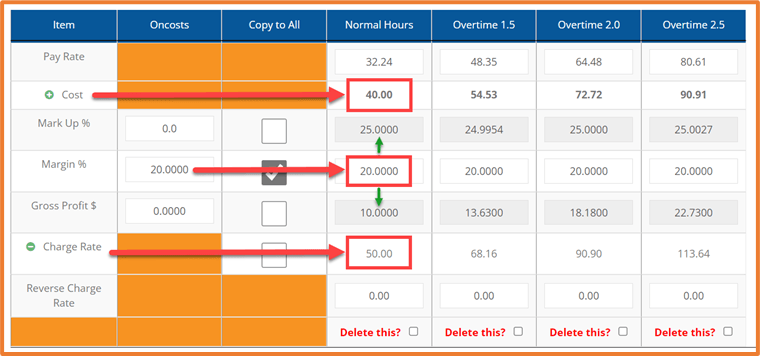

Let’s look at what a 20% margin would look like:

20% Margin from a cost rate of $40 = $50 charge rate ($10 profit)

Your charge rate, and gross profit, are now $2 higher per hour.

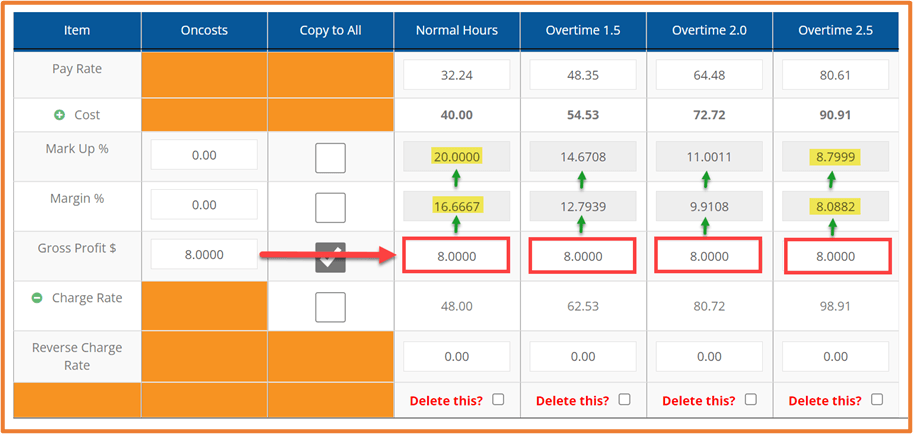

Here’s something else to look at –

our example with a dollar margin of $8.

Have a look at the margin and mark-up percentages across all pay rates ->

What might be a good return on normal hours, ends up being a lower profit margin as the pay increases.

This is definitely something to think about when deciding which profit margin is the right one to apply in your business!

Stay tuned, as we release more articles soon to help you understand the pros and cons of different charge rate calculations, and the ways that RatesCalc makes it easy!

Click the button below and let’s get started!

RatesCalc Pty Ltd | ABN: 45 615 192 991 | Website by Random Group